child tax credit 2021 dates irs

NOVEMBERs child tax credit cash will be sent out to parents in need across the country next weekThe stimulus check part of President Joe Bidens. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Half of the money will come as six monthly payments and half as a 2021 tax credit.

. Instead of calling it. For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit. IRSgovchildtaxcredit2021 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. To be issued after the court.

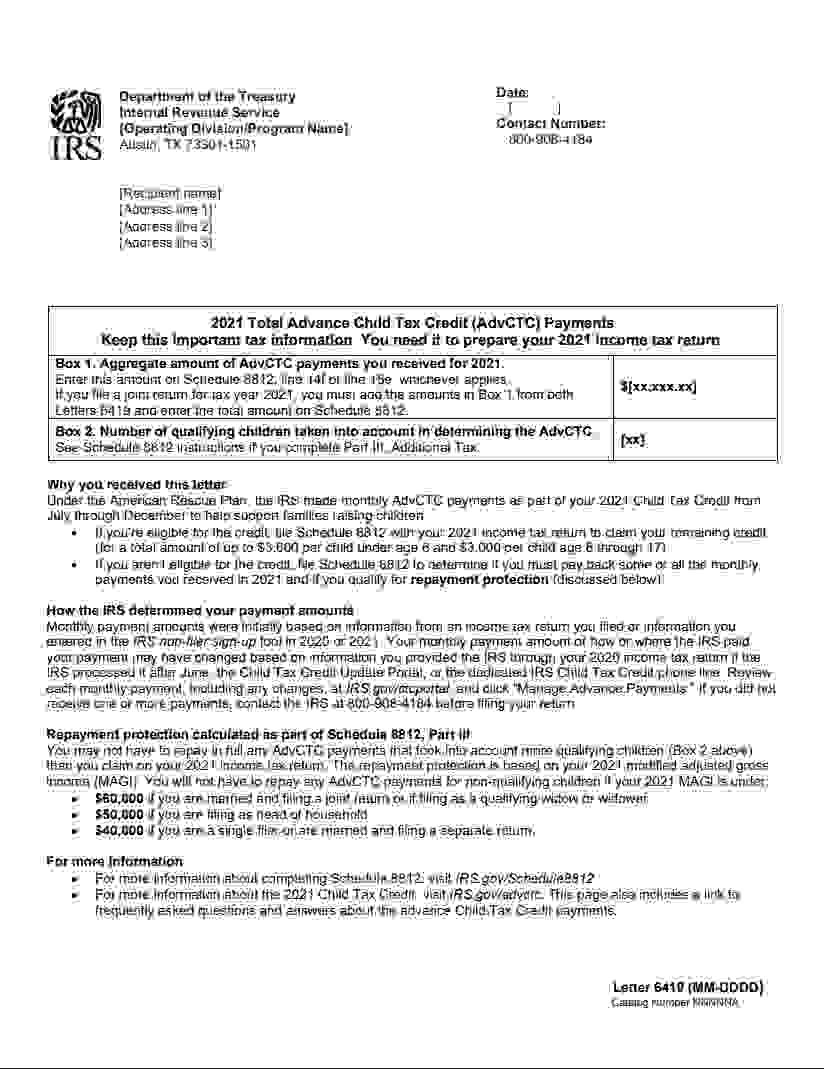

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and. Child Tax Credit This is in regards to 2020 taxes where i filed in September as i was waiting for the SSN for my daughter who was born in 2020. Get your advance payments total and number of qualifying.

That changes to 3000 for each child ages six through 17. 15 opt out by Aug. The IRS will pay 3600 total per child to parents of children up to five years of age.

The IRS sent six monthly child tax credit payments in 2021. A childs age determines the amount. That comes out to 300 per month through the.

The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for children under 6 and 3000 per kid for children. If they opt-in for the. The IRS provides the Child Tax Credit Eligibility Assistant portal that determines whether the family qualifies for the CTC.

But many families are also collecting the aid despite. The IRS will pay 3600 per child to parents of young children up to age five. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Very soon if you received advance payments of the Child Tax Credit you will be required to reconcile the payments received. For 2021 eligible parents or guardians. That comes out to 300 per month and.

The Child Tax Credit Update Portal is no longer available. If parents dont do this they will be able to. Will they send any more in 2022.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. To reconcile advance payments on your 2021 return. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line 8b plus the following amounts that.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. The IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit to parents of children up to age five.

13 opt out by Aug. The IRS said it will update its Child Tax Credit Update Portal later this year to allow parents to register children born or adopted in 2021. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Missing Advance Child Tax Credit Payment. IR-2021-153 July 15 2021. The chart below will help you determine the date when you should get your tax refund.

Half of the total will be paid as six. The IRS usually issues 9 out of 10 refunds within 10 days after efiling.

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

File Taxes For 2021 To Receive Your Full Child Tax Credit

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data Irs Tax Forms Tax Return Irs Forms

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

Child Tax Credit 2021 Changes Grass Roots Taxes

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Advance Monthly Payments Explained Donovan

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Dates As Irs Set To Send Out New Payments

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kokh